Français |

Français |  Read in English

Read in English

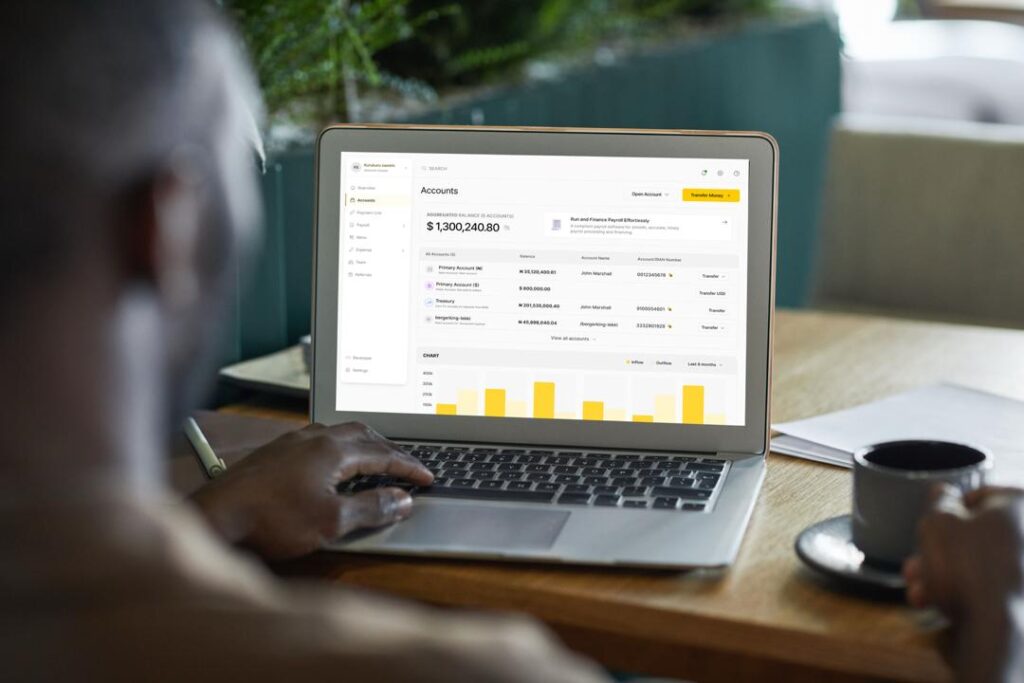

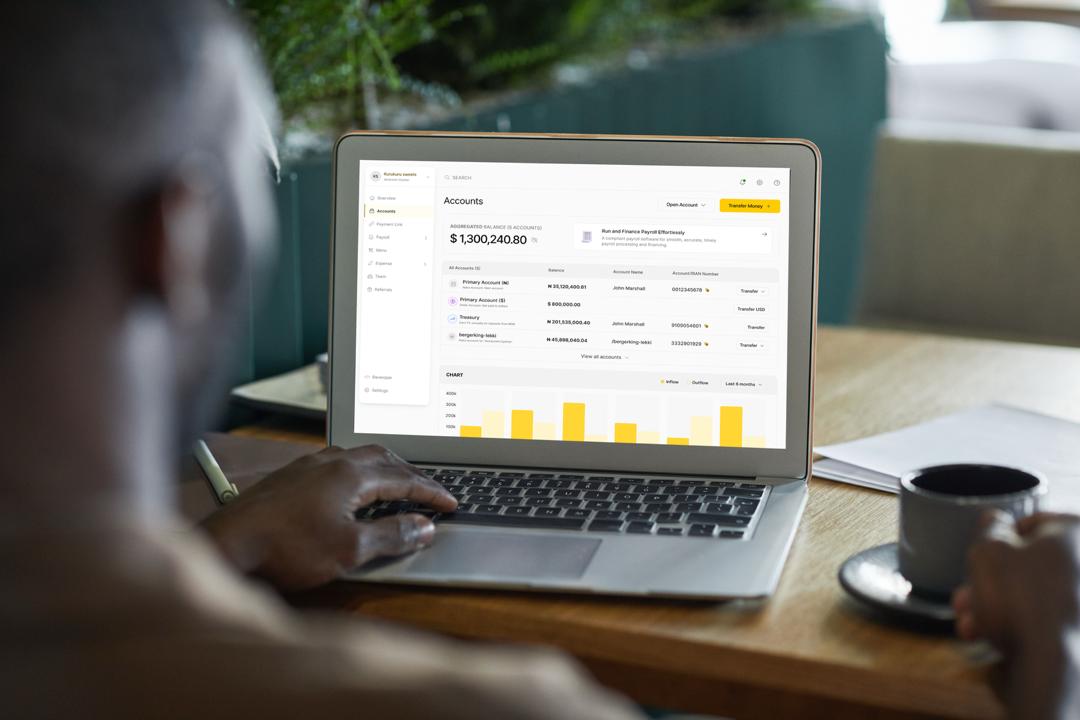

Following the acquisition of a Canadian payment services provider holding Payment Service Provider (PSP) and Money Services Business (MSB) licenses, African financial technology company Nomba has announced the rollout of a regulated cross-border payments infrastructure linking Africa and North America.

According to the company, the transaction aims to provide African businesses with direct access to North American trade flows, reducing reliance on traditional correspondent banking networks. Nomba, which operates a payments and business banking platform for enterprises, says it processes annual transaction volumes amounting to several trillion naira across domestic payments, banking services, and cross-border flows in Africa.

Deployment in the Democratic Republic of the Congo

As part of its expansion strategy, Nomba began operations in the Democratic Republic of the Congo (DRC) in November 2025, following a year of operational and regulatory preparation in Kinshasa.

The company has secured two key authorisations from the Central Bank of the Congo (BCC): a Messenger Financier licence and an Aggregator licence, enabling it to carry out inbound and outbound fund transfers in the Congolese market.

These approvals allow the platform to offer direct bank settlements through Rawbank, Equity BCDC and Trust Merchant Bank, as well as mobile money payments via M-Pesa, Airtel Money and Orange Money. According to the company, all services are accessible through a single application programming interface (API), with real-time settlement and built-in regulatory compliance.

Nomba said its expansion into the DRC was not driven solely by market size, despite the country recording annual remittance inflows exceeding $1.2 billion, but rather by an ambition to control payment infrastructure within an economy it considers strategic for African trade.

Canadian acquisition and oversight of cross-border flows

Alongside its African expansion, Nomba completed the acquisition of a regulated payments infrastructure in Canada in the second quarter of 2025, allowing it to operate locally and directly connect Canadian dollar (CAD) flows to African markets.

According to the company, this dual regulatory presence in Africa and North America provides a strategic advantage in overseeing business-to-business (B2B) cross-border financial transactions, particularly between Francophone Africa, Anglophone Africa and North America.

“Transactions between Africa and Canada are now live,” said Yinka Adewale, Chief Executive Officer of Nomba. “The next step is extending this infrastructure to other global markets.”

The acquisition enables the company to offer Canada-based CAD accounts, direct settlement into African currencies and same-day settlement timelines. Nomba said it has invested approximately $2 million in capital into the acquired entity to strengthen the infrastructure and support operational scale-up.

A focus on trade, excluding consumer remittances

Unlike many cross-border payment platforms operating in Africa, Nomba said its expansion into Canada is focused exclusively on commercial and professional flows, rather than consumer remittances.

Its target customers include exporters, importers, professional services firms, multinational suppliers and companies operating between Africa and North America in sectors such as energy, commodities, fast-moving consumer goods, services and technology.

The company said its solutions reduce dependence on intermediary banks and cut foreign exchange and transaction costs by between 40% and 60% compared with traditional channels.

Nomba said it processed $3.4 million in transactions through its Canadian infrastructure in January 2026 alone, reflecting steady growth since the start of the year.

“For businesses, reliability matters more than perceived innovation,” Adewale said, highlighting the importance of predictable settlement and immediate access to funds.

According to the company, all foreign exchange operations are conducted through its Canadian entity, providing clients with access to fully licensed and compliant cross-border banking infrastructure